The Health Savings Account (HSA) presents a unique financial puzzle: do you tap into it for everyday medical costs, or let it grow as a powerful, tax-advantaged savings vehicle for the distant future? This isn't a theoretical question; it's a real-world dilemma many face when using your HSA for current medical expenses vs. long-term savings. Finding the right balance can profoundly impact your financial well-being, offering both immediate relief and significant future security.

It's a decision that pits liquidity against growth, often leaving accountholders wondering if they're making the "right" choice. But here's the secret: there's no single "right" way. Instead, there's an optimal strategy for you, tailored to your current health needs, financial situation, and long-term aspirations.

At a Glance: Key Takeaways for Your HSA Strategy

- Triple Tax Advantage: HSAs offer pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- Dual Purpose: You can use your HSA as a spending account for immediate medical bills or as an investment vehicle for future healthcare costs, including retirement.

- Current Expenses (Pros): Immediate tax-free access, reduces taxable income.

- Current Expenses (Cons): Misses out on potential investment growth, leaves less for future large expenses.

- Long-Term Growth (Pros): Investments grow tax-free, compounding returns for a substantial future healthcare cushion.

- Long-Term Growth (Cons): Reduces immediate cash availability, subject to market risk.

- The Hybrid Solution: Set a "cash target" for near-term expenses and invest the rest. This offers both liquidity and growth potential.

- Estimate Your Cash Target: Review past expenses, anticipate future needs, and consider your comfort level with risk.

The HSA Advantage: A Financial Swiss Army Knife for Healthcare

Before diving into the "how-to" of balancing current vs. future needs, let's quickly recap why HSAs are so powerful. An HSA isn't just another savings account; it's a uniquely beneficial tool designed to complement high-deductible health plans (HDHPs). Its allure lies in its formidable "triple-tax advantage":

- Tax-Deductible Contributions: The money you put into your HSA isn't subject to federal income tax (and usually state income tax, depending on your state). If contributed through payroll, it's often pre-tax, meaning you reduce your taxable income upfront.

- Tax-Deferred Growth: Any interest, dividends, or investment gains your HSA funds generate grow completely tax-free. This allows your money to compound more aggressively over time.

- Tax-Free Withdrawals: When you take money out for understanding qualified medical expenses, those withdrawals are completely tax-free, both now and in retirement. This is what truly sets it apart from other retirement accounts like 401(k)s or IRAs, which often have taxable withdrawals in retirement.

This potent combination makes the HSA not just a payment method for healthcare, but a formidable savings and investment vehicle, especially for retirement planning. Indeed, for many, an HSA can be an even more powerful retirement tool than a traditional 401(k) or IRA due to this unique triple-tax treatment. If you're still weighing your options, understanding the full scope of benefits can help you decide if an HSA is right for you.

The Fork in the Road: Immediate Needs or Future Fortune?

With such a versatile account, the primary strategic question naturally arises: Do you treat your HSA like a checking account for medical bills, or like a long-term investment vehicle for future healthcare expenses, particularly in retirement? Each path has distinct advantages and disadvantages.

Using Your HSA for Current Medical Expenses

This approach treats your HSA as a convenient, tax-advantaged way to cover your routine and unexpected medical costs throughout the year.

The Upsides:

- Immediate Tax Savings: Every dollar you contribute directly reduces your taxable income, giving you an upfront tax break.

- Tax-Free Access: When you have a doctor's visit, need a prescription, or pay for a specialist, you can withdraw funds from your HSA completely tax-free to cover those qualified expenses. No need to dip into your regular checking account or credit card for these costs.

- No Penalties: As long as the withdrawals are for qualified medical expenses, there are no penalties, regardless of your age.

- Simplicity: It's straightforward. You contribute, you spend, and you reap the immediate tax benefits.

The Downsides: - Missed Growth Potential: This is the big one. Every dollar used for current expenses is a dollar that can't be invested and allowed to grow tax-free over years or decades. You're forfeiting the potential for compounding returns.

- Limited Future Cushion: A short-term focus might leave you financially unprepared for larger, unexpected medical costs in the future, or the significant healthcare expenses typically encountered in retirement. You're effectively leaving money on the table that could otherwise build into a substantial nest egg.

Investing Your HSA Funds for Future Growth

This strategy views your HSA primarily as a long-term investment account, aiming to maximize its tax-free growth potential. Instead of spending from it, you pay for current medical expenses out-of-pocket and let your HSA balance grow.

The Upsides:

- Compounding Power: This is where the magic happens. By investing your HSA funds in stocks, bonds, or mutual funds, they can grow significantly over time, completely tax-free. The longer your money stays invested, the more powerful compounding becomes.

- Massive Retirement Healthcare Cushion: Healthcare costs in retirement can be astronomical. An invested HSA can become a critical source of tax-free funds to cover Medicare premiums, deductibles, co-pays, and other out-of-pocket expenses, providing invaluable peace of mind. Many financial planners consider it one of the best ways for using your HSA for retirement healthcare costs.

- Ultimate Flexibility: Once you reach age 65, you can withdraw HSA funds for any purpose without penalty. While these withdrawals are subject to ordinary income tax if not for qualified medical expenses, it still offers incredible flexibility, essentially transforming your HSA into another retirement savings vehicle.

The Downsides: - Reduced Immediate Liquidity: If you pay for all current medical expenses out-of-pocket, you're using post-tax dollars from your regular income, which might strain your immediate cash flow.

- Market Fluctuations: Like any investment account, your HSA funds are subject to market volatility. The value can go down as well as up. If you need funds for an unexpected large medical expense and the market is down, you might have to sell investments at a loss.

- Discipline Required: This strategy demands financial discipline to consistently pay for current medical expenses out-of-pocket, especially when those costs are high.

The Hybrid Approach: Finding Your Perfect Balance with a "Cash Target"

For most people, the optimal strategy isn't an either/or choice, but a smart combination of both approaches. The key is to find a balance that provides enough liquidity for current needs while allowing the maximum possible amount to grow for the long term. This is where the concept of a "cash target" comes into play.

A "cash target" is a specific amount of money you aim to keep readily available in your HSA's cash (non-invested) portion to cover anticipated near-term qualified medical expenses. Once you've reached this target, any contributions beyond that amount can then be confidently invested for long-term growth. This strategy ensures you're never caught off guard by a medical bill while still harnessing the power of tax-free investing.

Think of it this way: your cash target is your HSA's "emergency fund" for medical needs. Everything above that is your "growth engine." And remember, even invested funds remain part of your HSA and can be liquidated (sold) back to your cash balance within a few business days if an urgent need arises, offering a vital safety net.

How to Set Your HSA "Cash Target": A Step-by-Step Guide

Estimating your cash target requires a bit of detective work and forward-thinking. It's not a one-time calculation; it's a dynamic number that you should revisit annually, especially during open enrollment when you're making health plan decisions.

Step 1: Gather Your Information – What Did You Spend Last Year?

The best predictor of future spending is often past spending. Dig into your records from the previous year to get a clear picture of your typical medical expenses.

- Sources to Check:

- Health Insurer's Website: Many insurers provide a comprehensive breakdown of your claims, deductibles, co-pays, and out-of-pocket maximums met. This is usually the most reliable source.

- Credit Card Statements/Bank Records: Look for charges from doctor's offices, hospitals, pharmacies, dentists, and vision care providers.

- Pharmacy Records: If you take regular prescriptions, your pharmacy can often provide an annual summary of your out-of-pocket costs.

- Personal Financial Trackers: If you use budgeting software or spreadsheets, this data should be readily available.

- What to Include: Count all qualified medical expenses you paid out-of-pocket. This includes:

- Co-pays for doctor's visits (primary care, specialists)

- Deductibles and co-insurance payments

- Prescription drug costs

- Mental health services

- Eye care (exams, glasses, contact lenses)

- Dental care (exams, cleanings, procedures, orthodontics)

- Over-the-counter medications purchased with a doctor's note (or on specific eligible lists)

Example: Last year, Sarah had $300 in co-pays, $700 for prescription drugs, $400 for dental work, and $100 for an eye exam. Her total was $1,500.

Step 2: Consider Expected Expenses – Adjust for the Coming Year

Your past spending is a baseline, but life changes. Adjust your previous year's estimate based on what you anticipate for the coming year.

- Subtract Non-Repeating Costs: Did you have a one-time procedure last year (e.g., wisdom teeth extraction, a specific diagnostic test) that isn't expected to recur? Subtract that cost.

- Add Anticipated Procedures: Are you planning a surgery, expecting a baby, or anticipating increased therapy sessions? Add estimated costs for these upcoming needs.

- Lifestyle Changes: Has your health status changed? Are you starting a new medication? Factor in how these changes might impact your spending.

- Plan Changes: Is your employer changing health plans? A new deductible, co-insurance, or network could significantly alter your out-of-pocket costs. Review your new plan documents carefully.

Example (continuing Sarah): Sarah's $400 dental work was a one-time crown. She also anticipates a new specialist visit for $200. So, her adjusted estimate is $1,500 (last year) - $400 (crown) + $200 (specialist) = $1,300.

Step 3: Review Contributions – How Much is Flowing In?

Compare your adjusted estimated spending to your current and anticipated HSA contributions. This includes both your own contributions (payroll deductions or direct contributions) and any employer contributions.

- Assess the Gap: Do your contributions cover your expected spending?

- If contributions fall short: You have a few options. You could increase your monthly contributions (if allowed) or make a one-time lump-sum contribution to bridge the gap. Just ensure you don't exceed the annual maximums.

- If contributions exceed spending: Great! This surplus is what you'll want to invest.

- Don't Forget Employer Contributions: Many employers contribute to employee HSAs as an added benefit. Factor these into your total annual contribution.

Example (continuing Sarah): Sarah contributes $100 per month ($1,200 annually), and her employer contributes $300 annually. Her total contributions are $1,500. Since her estimated spending is $1,300, she has a $200 surplus to consider investing.

Step 4: Select Your Cash Target – Your Comfort Zone

This is the subjective part, blending your estimated needs with your personal comfort level and risk tolerance. Your cash target should be a rolling total that you aim to maintain in your HSA's cash portion at any given time.

- The Baseline: At a minimum, your cash target should cover your expected annual medical expenses. This ensures you can cover your bills without dipping into investments. For Sarah, this would be $1,300.

- Adding a Buffer: Consider adding a buffer for unexpected costs.

- "Comfort Multiplier": Some people multiply their monthly expected spending by a factor (e.g., 2X, 3X, 6X) to determine a more robust cash target. If Sarah's monthly expenses average ~$108 ($1300/12), a 3X buffer would be $324. A 6X buffer would be $648.

- Deductible-Based: A more aggressive approach is to keep your full deductible in cash, ensuring you can meet this significant out-of-pocket maximum if a major event occurs. This offers maximum peace of mind but ties up more cash.

- Out-of-Pocket Maximum: For ultimate safety, you could aim to keep your plan's out-of-pocket maximum in cash. This is the absolute most you'd pay in a year for in-network care. This is a substantial sum but ensures all bases are covered.

Example (continuing Sarah): Sarah is comfortable keeping her estimated annual spending ($1,300) plus a 3-month buffer ($108 x 3 = $324) in cash. Her final cash target is $1,300 + $324 = $1,624. Any contributions beyond this amount will be invested.

Tips for Refining Your Cash Target: - Consider Your General Emergency Fund: If you have a robust general emergency fund, you might feel comfortable with a lower HSA cash target.

- Risk Tolerance: If market fluctuations make you nervous, a slightly higher cash target might bring you more peace of mind, even if it means slightly less investment growth.

- Review Regularly: Your health, plan, and comfort level can change. Make this an annual exercise.

Navigating HSA Contribution Limits

To fully leverage your HSA, it’s crucial to understand the annual contribution limits set by the IRS. These limits dictate the maximum amount you, your employer, and any family members can contribute to your HSA each year. These numbers are reviewed and adjusted periodically, so staying informed is key for strategies for maximizing your HSA contributions.

Here are the limits for upcoming years:

- 2025 Contribution Limits:

- Self-Only Coverage: $4,300

- Family Coverage: $8,550

- 2026 Contribution Limits:

- Self-Only Coverage: $4,400

- Family Coverage: $8,750

Important Considerations: - Employer Contributions Count: Any contributions your employer makes to your HSA directly count towards these annual limits. You need to subtract their contribution from the maximum to determine how much more you can contribute.

- Catch-Up Contributions: If you are age 55 or older during the tax year, you are eligible to make an additional catch-up contribution of $1,000 per year.

- For spouses: If both you and your spouse are 55 or older and covered by a family HDHP, each of you can make a $1,000 catch-up contribution. However, each spouse needs to have their own HSA to make their individual catch-up contribution. A single family HSA can only have one catch-up contribution.

These limits are important to avoid penalties. Always double-check the current year's limits with your HSA custodian or the IRS website.

Beyond the Basics: Advanced HSA Strategies

Once you've mastered the cash target, there are even more ways to optimize your HSA for long-term benefit.

The "Pay Yourself Back" Strategy

This is an advanced technique for maximizing long-term growth. Instead of immediately withdrawing HSA funds for qualified medical expenses, you pay those expenses out-of-pocket (from your regular checking account or credit card) and keep meticulous records of them. Later, perhaps years or even decades down the road, you can reimburse yourself for those past qualified expenses from your HSA, tax-free.

- How it Works:

- Pay a qualified medical expense today with non-HSA funds.

- Keep the receipt or documentation of that expense indefinitely.

- Let your HSA funds grow, undisturbed, for as long as possible.

- At a future date (e.g., retirement), withdraw money from your HSA up to the total amount of your accumulated, unreimbursed qualified medical expenses. This withdrawal is tax-free.

- Why it's Powerful: It allows your HSA investments to grow for longer, creating a much larger pool of tax-free money in retirement. You effectively get to "pay yourself back" with tax-free dollars that have potentially grown significantly.

- Key Requirement: Impeccable record-keeping is critical. You must be able to prove that the prior expenses were qualified and that you haven't been reimbursed for them before.

Maximizing Contributions When You Can

If your budget allows, try to contribute the maximum amount to your HSA each year. The more you put in, the more you save on taxes today, and the more you have to invest for tomorrow. Even small, consistent contributions add up significantly over time.

Common Questions and Misconceptions About HSA Usage

Let's address a few frequent concerns that arise when people are deciding how to use their HSA.

Q: What if I need the money from my investments quickly for an unexpected medical bill?

A: Most HSA providers allow you to liquidate (sell) your investments and transfer the funds to your cash balance within a few business days, typically 1-3. While not instantaneous, it's usually quick enough for most medical emergencies, especially if you also maintain a general emergency fund. Your cash target also provides an immediate buffer.

Q: Is it risky to invest my HSA money?

A: Like any investment, HSA investments are subject to market risk. The value of your investments can go down. However, for long-term goals (5+ years), market downturns are often temporary, and historically, diversified investments tend to grow over time. The tax-free growth potential significantly outweighs the short-term risks for those with a long time horizon. Your choice of different investment options available for HSAs will dictate your risk exposure.

Q: What happens to my HSA if I change jobs or health plans?

A: Your HSA is your account. It's portable. If you change jobs, lose your HDHP eligibility, or switch to a non-HDHP plan, the money in your HSA remains yours. You can continue to use it for qualified medical expenses, and it will continue to grow tax-free. However, you cannot contribute new funds to it unless you are enrolled in another qualifying HDHP.

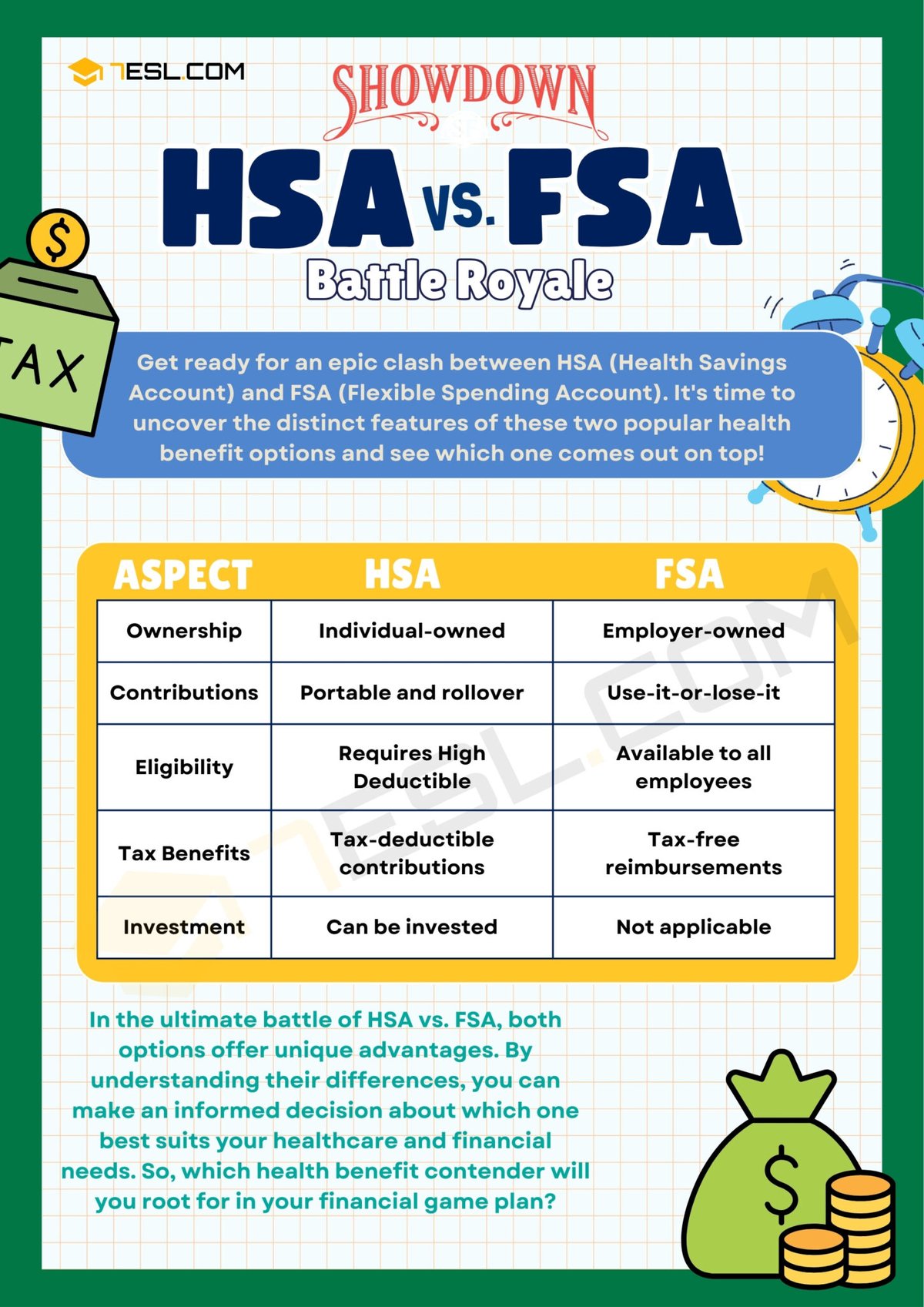

Q: How does an HSA compare to an FSA?

A: A Flexible Spending Account (FSA) also offers tax advantages for medical expenses, but it's a "use it or lose it" account tied to your employer. Funds typically expire at the end of the plan year (with some minor carryover exceptions). An HSA, by contrast, is a savings account that you own, and the funds roll over year after year and stay with you, even if you change jobs. Understanding how an HSA compares to an FSA is crucial when choosing the right account for your needs.

Q: Do I have to pay income taxes on my HSA distributions after age 65 if not used for medical expenses?

A: Yes. After age 65, you can withdraw funds from your HSA for any purpose without penalty. However, if those withdrawals are not for qualified medical expenses, they will be subject to ordinary income tax, much like a traditional 401(k) or IRA withdrawal. The tax-free withdrawal for qualified medical expenses remains regardless of age.

Making Your HSA Work for You

The decision of whether to use your HSA for current medical expenses or invest it for long-term growth boils down to your personal circumstances, risk tolerance, and financial goals. There's no single perfect strategy, but rather a dynamic approach that evolves with your life.

By diligently estimating a "cash target" to cover your immediate healthcare needs, you empower yourself to confidently invest the remaining balance. This hybrid strategy allows you to benefit from the immediate tax advantages of HSA contributions, maintain peace of mind with readily available funds for day-to-day medical costs, and harness the immense power of tax-free growth for your future health and financial security.

Take the time to review your health expenses and financial situation annually. Adjust your cash target as needed, and consistently contribute what you can. Your HSA is a powerful tool; wielding it wisely can be one of the smartest financial moves you make.