In today's complex healthcare landscape, finding ways to manage medical costs while also building financial security is more important than ever. You've likely heard of a Health Savings Account (HSA), but the big question remains: Is an HSA worth it for your specific health needs and financial goals? This comprehensive guide will serve as your go-to resource, breaking down everything you need to know and connecting you to deeper insights on each aspect. An HSA is a powerful tool, often paired with a High-Deductible Health Plan (HDHP), designed to give you significant control over your healthcare dollars, both now and in the future. But like any financial decision, understanding its full scope is crucial.

Understanding the Foundation: What is an HSA?

At its core, a Health Savings Account (HSA) is a tax-advantaged savings account that works hand-in-hand with a qualifying High-Deductible Health Plan (HDHP). Think of it as your personal medical expense fund, but with significant financial perks. Employers often play a role, offering these plans to help manage healthcare costs for their workforce, sometimes even contributing to employee accounts. This pairing usually means lower monthly premiums for you, with the understanding that you'll cover smaller medical costs out-of-pocket until your deductible is met, at which point your insurance kicks in for major events.

To fully grasp the mechanics and strategic benefits of this powerful duo, delve deeper into What is an HSA and how does it work.

Unlocking the Triple Tax Advantage: A Key Benefit

One of the most compelling reasons to consider an HSA is its unique "triple tax advantage." This isn't just a catchy phrase; it represents three distinct ways an HSA can save you money on taxes, making it an incredibly efficient savings vehicle for healthcare and beyond.

Contributions, Growth, and Withdrawals: The Tax-Free Trifecta

First, the money you contribute to an HSA is federally tax-deductible, effectively lowering your taxable income for the year. Second, once those funds are in your account, they grow tax-free. This means any interest, dividends, or investment gains accumulate without being taxed year after year. Finally, and perhaps most impressively, withdrawals made for qualified medical expenses are also completely tax-free. It's rare to find an account that offers such comprehensive tax benefits across the entire lifecycle of your funds.

To truly understand HSAs triple tax advantage, exploring its nuances can unlock significant financial potential.

Who Can Get an HSA and Who Benefits Most?

While HSAs offer impressive benefits, they aren't for everyone. Eligibility is strictly tied to your health insurance plan and other factors, and the "worth" of an HSA often depends on your individual health profile and financial strategy.

Eligibility Requirements: Are You In?

To be eligible for an HSA, you must be enrolled in a qualifying High-Deductible Health Plan (HDHP). For 2026, this means your plan needs a deductible of at least $1,700 for individuals or $3,400 for families. Beyond that, you cannot be covered by another non-HDHP health plan (like a spouse's traditional plan), be enrolled in Medicare, or be claimed as a dependent on someone else's tax return. Unlike some other tax-advantaged accounts, there are no income limits to contribute to an HSA, opening the door for higher wage earners to enjoy its tax-reducing perks.

Is an HSA Right for Your Lifestyle?

HSAs shine particularly bright for younger and healthier individuals who typically have low medical expenses. They can maximize their employer contributions, benefit from lower monthly premiums, and strategically build a substantial, tax-free nest egg for future medical needs. The long-term investment potential of HSA funds makes them ideal for retirement healthcare planning. However, if you have chronic medical conditions or anticipate significant medical care, a traditional health plan with more predictable costs through copays and lower deductibles might be a more suitable choice for your immediate financial peace of mind.

Using Your HSA: From Daily Needs to Future Investments

One of the greatest strengths of an HSA is its flexibility. You can use it to cover immediate medical costs, or you can leverage its investment potential to build a significant financial resource for the future.

Qualified Medical Expenses: What Your HSA Covers

HSA funds can be used for an extensive list of qualified medical expenses for yourself, your spouse, and your dependents. This includes everything from routine doctor visits and prescription medications to major medical procedures, dental care, vision care (including glasses and LASIK), and various therapies like physical or mental health support. Even certain over-the-counter medications are covered. In specific scenarios, such as when you're under COBRA or receiving unemployment benefits, your HSA can even cover health insurance premiums.

When it comes to managing your health costs, here are a few options for strategically utilizing your HSA funds, whether you need them now or prefer to let them grow for the future.

Contributing & Growing Your Funds: More Than Just a Spending Account

For 2026, you can contribute up to $4,400 as an individual or $8,750 for families annually. If you're 55 or older, an additional "catch-up" contribution of $1,000 per year is allowed. These contributions can often be made conveniently through payroll deductions, and many employers even contribute to employee HSAs, giving your savings an extra boost. What sets HSAs apart is that if you don't immediately need the money for medical costs, you can invest it. Many HSA providers offer investment options like mutual funds, ETFs, and stocks once you reach a minimum balance, allowing your healthcare savings to truly compound over time.

Thinking about long-term growth? Explore HSA as an Investment and a powerful component of your retirement planning.

HSA vs. Other Financial Tools: Making the Right Choice

With various savings and spending accounts available, it's easy to get confused. Understanding how an HSA stacks up against other common financial tools can help you make an informed decision about where to allocate your hard-earned money.

HSA vs. FSA vs. 401(k): Understanding the Differences

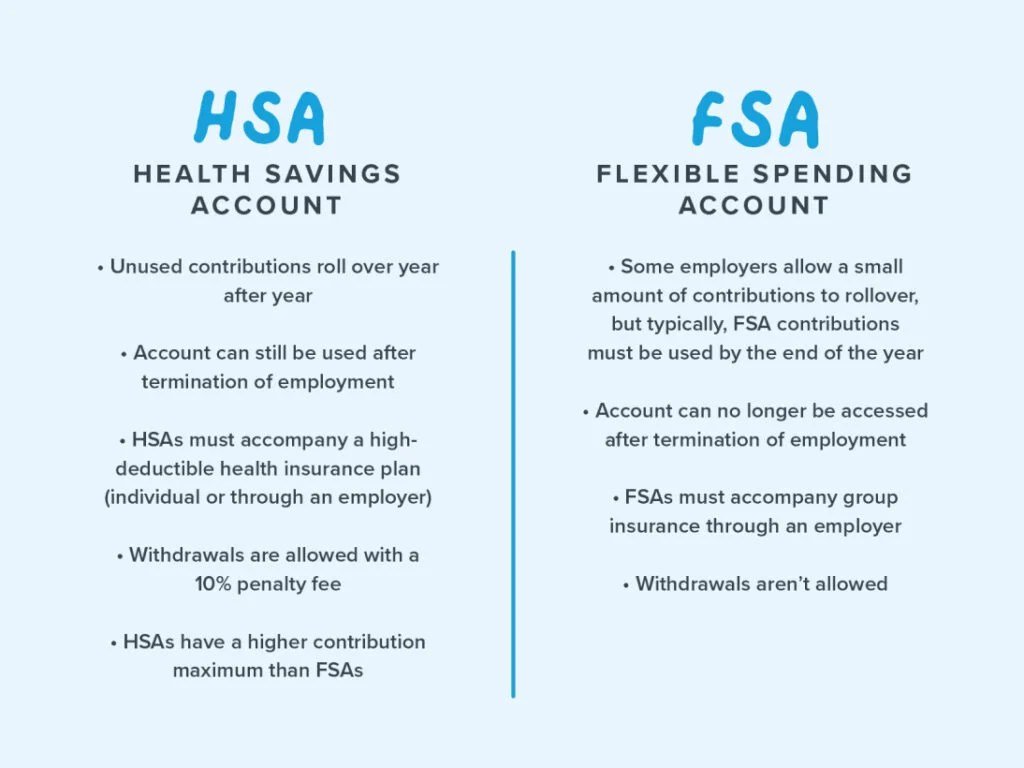

An HSA stands out significantly from a Flexible Spending Account (FSA). While both cover medical expenses, FSA funds are employer-sponsored, typically operate on a "use it or lose it" basis within a plan year, and are usually forfeited if you leave your company. HSA funds, in stark contrast, are owned by you, are fully portable if you change jobs or health plans, and roll over year-to-year indefinitely. When compared to an HMO, which offers discounted rates within a restricted network and often has low or no deductibles, the HDHP/HSA combo provides greater flexibility in choosing providers, albeit with higher out-of-pocket costs before meeting your deductible.

Deciding which account is right for you often comes down to your individual circumstances, current health needs, and long-term financial goals.

Important Considerations and Potential Pitfalls

While the advantages of an HSA are clear, it's essential to approach it with a full understanding of its requirements and potential drawbacks. No financial tool is without its considerations.

The HDHP Factor: Understanding Your Deductible

The primary consideration with an HSA is its mandatory pairing with a High-Deductible Health Plan (HDHP). This means you'll be responsible for a higher amount of out-of-pocket costs before your insurance starts covering expenses. For some, this upfront financial exposure can be a barrier, particularly if they anticipate frequent medical care or have unpredictable health needs. It's crucial to assess your past healthcare spending and your comfort level with this deductible structure.

Non-Medical Withdrawals: The Rules to Know

The tax advantages of an HSA are specifically tied to qualified medical expenses. If you withdraw funds from your HSA for non-medical reasons before age 65, those withdrawals are subject to ordinary income taxes and a hefty 20% penalty. After age 65, the 20% penalty is waived, but non-medical withdrawals are still taxed as ordinary income, similar to a traditional IRA. This makes the HSA a powerful long-term savings tool that incentivizes medical expense usage.

Making Your Informed Decision

So, is an HSA worth it for you? The answer isn't a simple yes or no. It's a strategic decision that weighs your current health, anticipated medical needs, financial situation, and long-term savings goals. For many, especially those who are relatively healthy and have the financial capacity to cover a higher deductible, an HSA offers an unparalleled opportunity to save on taxes, invest for the future, and take control of their healthcare finances. By exploring the detailed guides linked throughout this super pillar, you'll gain the clarity needed to determine if an HSA is the right fit for your health and wealth journey.