Navigating the landscape of financial accounts can feel like deciphering a secret code. You've likely heard of HSAs, FSAs, and 401(k)s, but understanding how they differ and, more importantly, HSA vs. FSA vs. 401(k): Which Account is Best for You? can be a real challenge. Many people leave money on the table or miss out on significant tax advantages simply because they don't fully grasp how these powerful tools can work for them.

These accounts aren't just acronyms; they're opportunities to save thousands on taxes, pay for healthcare, and build a secure retirement. This guide will cut through the jargon, comparing each account in plain language so you can confidently make the best choices for your financial health.

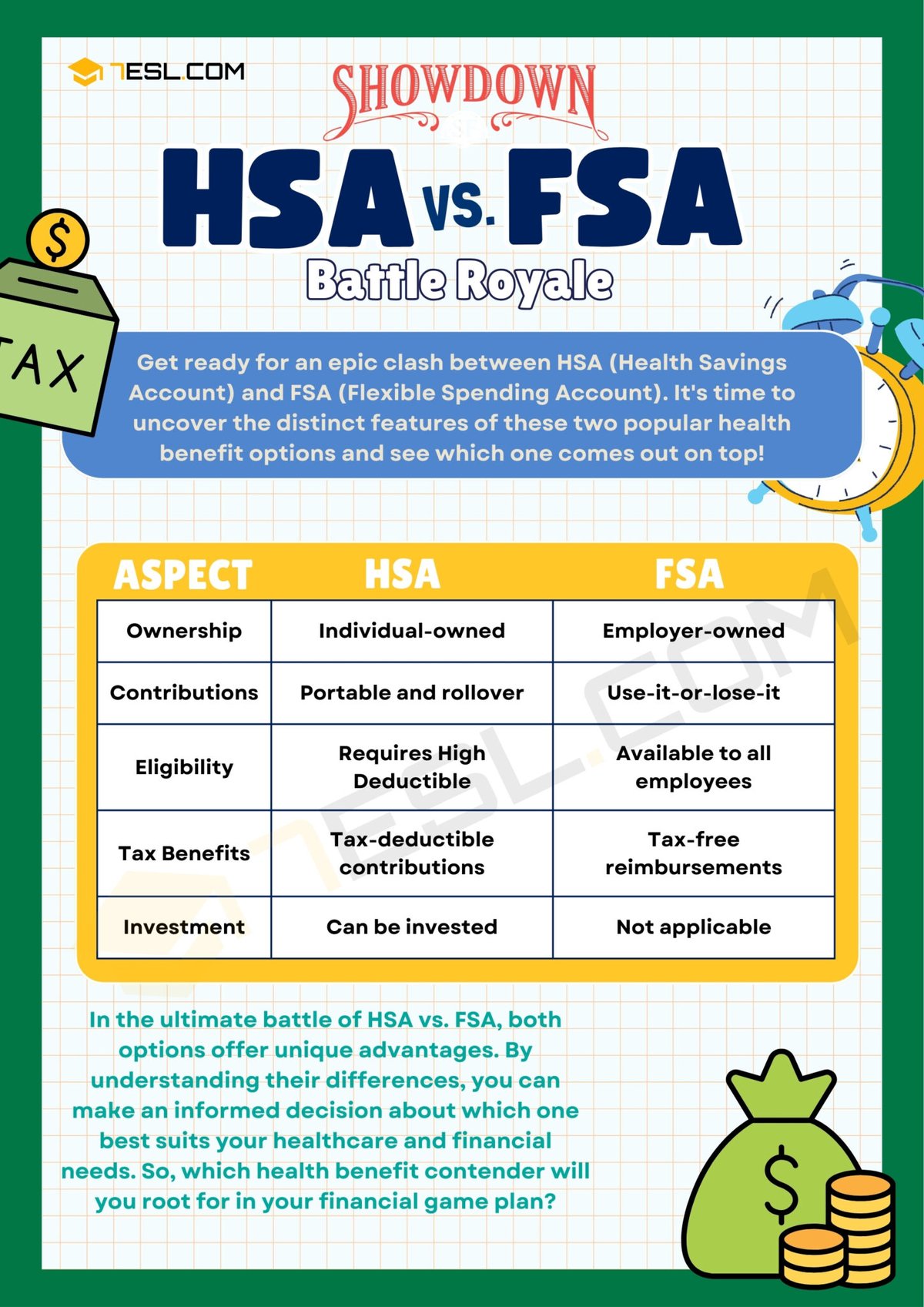

At a Glance: Your Quick Comparison

Before we dive deep, here's a snapshot of what makes each account unique:

- HSA (Health Savings Account): A personal savings account for health expenses, but also a stealthy retirement investment vehicle. It offers triple tax advantages (pre-tax contributions, tax-free growth, tax-free withdrawals for qualified medical expenses) and you own it forever.

- FSA (Flexible Spending Account): An employer-sponsored account for health or dependent care costs, funded with pre-tax dollars. It's often "use-it-or-lose-it" by year-end, meaning it's best for predictable, near-term expenses.

- 401(k) (Retirement Plan): An employer-sponsored investment account designed specifically for retirement savings, offering immediate tax breaks on contributions and tax-deferred growth. Often includes a valuable employer match.

The Power of Pre-Tax Dollars: A Shared Foundation

What do an HSA, FSA, and 401(k) all have in common? They let you pay for expenses with pre-tax dollars. This is a game-changer. When you contribute to these accounts, that money is typically deducted from your paycheck before federal income tax, FICA taxes (Social Security and Medicare), and often state income tax are calculated.

Think about it: If your combined federal, FICA, and state tax rate is 30%, every dollar you put into one of these accounts is effectively worth $1.30 compared to money you'd spend after taxes. That's a huge boost to your purchasing power and a significant chunk of change saved annually.

Deep Dive: The Health Savings Account (HSA) – A Triple Threat

The HSA is arguably the most powerful, yet often misunderstood, financial tool available to eligible individuals. It's not just for healthcare; it's a potent retirement savings vehicle.

Eligibility: Your Health Plan is Key

To open and contribute to an HSA, you must be enrolled in a High-Deductible Health Plan (HDHP) that is HSA-eligible. You cannot have any other disqualifying health coverage (like a traditional PPO or Medicare). This is the absolute non-negotiable gateway. HSAs are member-owned, so you can open one even if your employer doesn't offer it, as long as you meet the HDHP requirement.

The "Triple Tax Advantage" Explained

This is where the HSA truly shines:

- Tax-Deductible Contributions: Money goes in pre-tax, reducing your taxable income. If your contributions are deducted from your paycheck, they're typically exempt from FICA taxes too. If you contribute directly, you can deduct them on your tax return.

- Tax-Free Growth: Any investments within your HSA grow tax-free. You won't pay capital gains or dividend taxes on earnings.

- Tax-Free Withdrawals: When you use the money for qualified medical expenses, the withdrawals are completely tax-free. This includes deductibles, copayments, prescriptions, and even dental and vision care.

This "triple threat" makes the HSA unique among all savings accounts.

Investing for the Long Haul

Unlike an FSA, an HSA allows you to invest the funds within the account. Many HSA providers offer a range of investment options, from mutual funds to ETFs. This means your unused health savings can grow significantly over time, becoming a substantial nest egg for future medical costs—or even general retirement expenses. For many, investing HSA funds is a critical component of their long-term financial strategy. Curious whether this unique account fits into your financial picture? Here's how to figure out Is an HSA worthwhile?.

Ownership and Portability: It's Yours Forever

An HSA is your account, not tied to your employer. If you change jobs, change health plans, or retire, the money goes with you. You maintain full control over the funds, and they never expire. This permanent ownership makes it incredibly flexible and reliable for future healthcare needs.

The Ultimate Retirement Savings Account (Yes, Really!)

Here's a secret many people miss: The HSA is one of the best retirement accounts available, especially after age 65.

- Pre-65: Funds must be used for qualified medical expenses to remain tax-free and penalty-free.

- Post-65: At age 65, the 20% penalty for using HSA funds for non-qualified expenses is waived. While you'd still pay ordinary income tax on non-qualified withdrawals (just like a traditional 401(k) or IRA), withdrawals for qualified medical expenses remain completely tax-free.

This flexibility makes the HSA a powerful dual-purpose account: healthcare savings now, and an emergency fund or supplemental retirement income later. Fidelity estimates that a 65-year-old individual may need $172,500 in after-tax savings for health care expenses in retirement. An HSA is perfectly positioned to help you meet that challenge.

HSA Pros and Cons

Pros:

- Triple tax advantage (contributions, growth, qualified withdrawals).

- Funds never expire; they roll over year to year.

- You own the account; it's fully portable.

- Investment opportunities for long-term growth.

- Can be used for general expenses after age 65 (with income tax).

- Employer contributions (if offered) are tax-free.

Cons: - Requires enrollment in an HSA-eligible HDHP.

- Funds accumulate as contributions are made, not available immediately.

- Contributions have annual limits set by the IRS.

- Withdrawals for non-qualified expenses before age 65 incur a 20% penalty (plus income tax).

Deep Dive: The Flexible Spending Account (FSA) – Predictable Benefits

The FSA is another valuable tool for saving on healthcare costs, but it operates quite differently from an HSA. It's designed for more immediate, predictable expenses.

Employer-Sponsored & Plan-Specific

An FSA is an employer-offered benefit. If your employer doesn't offer one, you can't have one. Unlike an HSA, an FSA is compatible with virtually any health plan—you don't need an HDHP. Eligibility is simply based on your employer's offering.

The "Use-It-or-Lose-It" Rule (Mostly)

The defining characteristic of an FSA is its "use-it-or-lose-it" rule. Funds generally expire at the end of each plan year. If you don't spend the money, you forfeit it. However, many employers now offer one of two exceptions (they cannot offer both):

- Carryover: You can carry over a limited amount of unused funds to the next plan year (e.g., up to $660 from 2025 to 2026).

- Grace Period: You have an extended period (up to 2.5 months) into the next plan year to use the previous year's funds.

It's crucial to check with your employer about their specific FSA rules.

Upfront Access to Funds

One significant advantage of an FSA is that the entire annual contribution amount is available on day one of the plan year. This acts like a cash advance from your employer, which can be incredibly helpful if you anticipate a large medical expense early in the year (e.g., surgery, childbirth). You can spend the full amount, even if you haven't contributed it all yet through payroll deductions.

No Investment, No Portability

FSA funds cannot be invested for growth, nor are they portable. If you leave your job (unless you're eligible and elect COBRA), any unused funds are typically forfeited. This reinforces its design as a short-term spending account.

Types of FSAs

While the most common is a healthcare FSA, there's also a Dependent Care FSA (DCFSA) for childcare or elder care expenses, and a Limited Purpose FSA (LPFSA) which covers only dental and vision expenses.

FSA Pros and Cons

Pros:

- Immediate access to the full elected amount at the start of the plan year.

- Contributions are pre-tax (federal, FICA, often state).

- Compatible with virtually any health plan.

- Covers a wide range of qualified medical expenses.

- Dependent Care FSAs save money on childcare costs.

Cons: - "Use-it-or-lose-it" rule (unless carryover/grace period applies).

- Not portable; funds typically forfeited upon leaving a job.

- Cannot be invested for growth.

- Must be offered by an employer.

- Contributions have annual limits set by the IRS.

Deep Dive: The 401(k) – Your Retirement Cornerstone

While HSAs and FSAs focus on health expenses, the 401(k) is squarely aimed at your long-term financial security in retirement. It's the primary retirement savings vehicle for many Americans.

Purpose: Building Retirement Wealth

A 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their pre-tax (traditional 401(k)) or after-tax (Roth 401(k)) salary to an investment account. The core purpose is to save and invest for retirement decades down the road.

Traditional vs. Roth 401(k)

- Traditional 401(k): Contributions are made with pre-tax dollars, reducing your current taxable income. Your investments grow tax-deferred, meaning you don't pay taxes until you withdraw the money in retirement. This is ideal if you expect to be in a lower tax bracket in retirement than you are now.

- Roth 401(k): Contributions are made with after-tax dollars, so there's no immediate tax deduction. However, your investments grow tax-free, and qualified withdrawals in retirement are completely tax-free. This is often preferred if you expect to be in a higher tax bracket in retirement.

The All-Important Employer Match

One of the most compelling reasons to contribute to a 401(k) is the employer match. Many companies will contribute a certain amount to your 401(k) based on how much you contribute. This is essentially free money and a guaranteed return on your investment. Always contribute at least enough to get the full employer match – it's often the smartest financial move you can make.

Investment Focus, Long-Term Growth

A 401(k) is inherently an investment account. Your contributions are invested in various funds (stocks, bonds, mutual funds) chosen from a menu provided by your plan administrator. The goal is long-term growth through compounding returns.

Withdrawal Rules: Age 59.5

Funds in a 401(k) are intended for retirement. Generally, you can't access them without penalty before age 59.5. Withdrawals before this age typically incur a 10% penalty in addition to ordinary income taxes (for traditional 401(k)). There are some exceptions, such as the rule of 55 for those who leave their job in or after the year they turn 55.

401(k) Pros and Cons

Pros:

- Significant tax advantages (pre-tax contributions or tax-free withdrawals).

- Employer matching contributions (free money!).

- High annual contribution limits.

- Tax-deferred (Traditional) or tax-free (Roth) investment growth.

- Automatic payroll deductions make saving easy.

Cons: - Funds are generally inaccessible without penalty before age 59.5.

- Limited investment options compared to an IRA or brokerage account.

- Fees can sometimes be higher than other investment vehicles.

- Not portable in the same way an HSA is (though you can roll it over to a new 401(k) or IRA).

- Tied to your employment (though you can roll it over if you leave).

HSA vs. FSA vs. 401(k): A Side-by-Side Comparison

To truly understand the distinctions, let's put these accounts next to each other.

| Feature | Health Savings Account (HSA) | Flexible Spending Account (FSA) | 401(k) Retirement Plan |

|---|---|---|---|

| Primary Purpose | Healthcare expenses (current & future); Retirement savings | Short-term healthcare expenses; Dependent care | Retirement savings |

| Eligibility | Must have HSA-eligible HDHP; no other disqualifying coverage | Employer-offered; typically requires employment; compatible with any health plan | Employer-offered; typically requires employment |

| Account Ownership | Individual (portable) | Employer-owned (not portable; forfeited upon leaving job) | Individual, but tied to employer (portable via rollover) |

| Fund Carryover | Yes, 100% of unused funds carry over indefinitely | No (generally "use-it-or-lose-it"); limited carryover or grace period may apply | Yes, 100% of unused funds carry over indefinitely |

| Investment Opportunity | Yes, funds can be invested for tax-free growth | No, funds cannot be invested | Yes, funds are invested for tax-deferred/tax-free growth |

| Initial Fund Availability | As contributions are made | Yes, 100% elected amount available on day one | As contributions are made |

| Tax Advantages | Triple: Pre-tax contributions, tax-free growth, tax-free qualified withdrawals | Pre-tax contributions, tax-free qualified withdrawals | Pre-tax contributions (Traditional) or tax-free withdrawals (Roth) |

| Retirement Use | Yes, funds can be used for medical expenses tax-free; non-medical post-65 (taxable) | No, funds cannot be used for retirement medical expenses | Yes, designed for retirement income |

| Employer Match | Sometimes offered (tax-free contributions) | Not applicable | Often offered (significant benefit) |

| Can Combine With | Limited Purpose FSA (dental/vision only) | Dependent Care FSA; generally not with an HSA (unless LPFSA) | IRAs, HSAs, taxable brokerage accounts |

Choosing Your Champion: A Decision-Making Framework

Deciding which account is best depends heavily on your individual circumstances, health plan, and financial goals. Let's break down common scenarios:

Scenario 1: You Have an HDHP and Minimal or Unpredictable Medical Expenses (HSA First!)

If you're eligible for an HSA (meaning you have an HDHP), prioritize it. It's the most versatile and tax-efficient savings vehicle.

- Action: Maximize your HSA contributions if possible. Aim to pay for current medical expenses out-of-pocket (if affordable) and let your HSA funds grow through investments. This strategy allows the "triple tax advantage" to truly compound over decades, making your HSA a powerful retirement asset.

Scenario 2: You Have Predictable Medical or Dependent Care Expenses (FSA is Your Friend)

If you're not eligible for an HSA, or if you have specific, recurring medical costs (like prescriptions, therapy, or childcare if you use a Dependent Care FSA), an FSA can be incredibly valuable.

- Action: Carefully estimate your annual qualified expenses. Contribute enough to your FSA to cover these known costs. The immediate access to funds and pre-tax savings make it a smart choice for short-term budgeting. Just be mindful of the "use-it-or-lose-it" rule and your employer's specific carryover or grace period policies.

Scenario 3: Your Primary Goal is Long-Term Retirement Savings (401(k) is Core!)

For pure retirement planning, the 401(k) is indispensable.

- Action: Always contribute at least enough to your 401(k) to get the full employer match. This is free money you shouldn't pass up. After securing the match, you can then consider other savings vehicles, including maximizing your HSA or an IRA, before contributing further to your 401(k) if you wish.

Scenario 4: You Want to Maximize Both Health and Retirement Savings

This is the ideal strategy for many financially savvy individuals.

- Action:

- Contribute enough to your 401(k) to get the full employer match.

- Maximize your HSA contributions, especially if you plan to invest the funds for retirement healthcare expenses.

- If you still have savings capacity and predictable, short-term healthcare needs, consider contributing to a Limited Purpose FSA (for dental and vision only) if you have an HSA, or a regular FSA if you don't have an HSA.

- If you have childcare expenses, fund a Dependent Care FSA.

- Once you've maximized these accounts, consider contributing beyond the 401(k) match or to an IRA.

Common Questions & Misconceptions

Let's clear up some common points of confusion.

Can I have both an HSA and an FSA?

Generally, no, you cannot contribute to a regular healthcare FSA and an HSA in the same year. However, you can have an HSA alongside a Limited Purpose FSA (LPFSA), which covers only dental and vision expenses. This is a popular strategy for HSA owners to cover those specific costs with pre-tax dollars without touching their HSA investments. You can also have an HSA and a Dependent Care FSA (DCFSA) simultaneously, as they serve different purposes.

What if I change jobs?

- HSA: Your HSA is yours to keep, regardless of employment changes. It's fully portable.

- FSA: Funds are typically forfeited upon leaving a job. Some employers may allow you to continue contributing under COBRA, but this is less common for FSAs.

- 401(k): You usually have a few options: leave it with your old employer (if allowed and fees are reasonable), roll it over into your new employer's 401(k) plan, or roll it over into an Individual Retirement Account (IRA).

Is an HSA better than a 401(k)?

This isn't an "either/or" question for most people; it's about sequence. The 401(k) is typically the foundation for broad retirement savings, especially due to the employer match. The HSA, however, offers unique tax benefits (especially post-65) that make it potentially superior for healthcare expenses in retirement, and a strong contender for overall retirement savings after you've secured your 401(k) match. Many financial advisors recommend: 1) 401(k) up to the match, 2) Maximize HSA, 3) Maximize IRA, 4) Maximize 401(k).

What are "qualified medical expenses"?

These are expenses that generally would be tax-deductible as medical expenses if you itemized deductions on your tax return. They include a wide range of services and products, such as:

- Doctor's visits, copayments, deductibles

- Prescription medications

- Dental care, orthodontia

- Vision care, glasses, contacts

- Chiropractic care

- Acupuncture

- Certain over-the-counter medications (with a prescription or specific items like pain relievers or cold medicine)

- Breast pumps and supplies

- Long-term care services

Always check the IRS Publication 502, "Medical and Dental Expenses," or your plan administrator for the most up-to-date and complete list.

Maximizing Your Benefits: Pro Tips & Strategies

Now that you understand the nuances, here are some actionable strategies to make the most of these powerful accounts:

- Never Miss the 401(k) Match: This is non-negotiable. If your employer offers a match, contribute enough to get every penny. It's an instant, guaranteed return on your investment.

- Prioritize the HSA if Eligible: If you're in an HDHP, the HSA should be a top priority. Its triple tax advantage and long-term investment potential are unmatched. Think of it as a retirement fund with a healthcare bonus.

- Estimate FSA Needs Carefully: For FSAs, be realistic about your upcoming expenses. Don't over-contribute, or you risk forfeiting funds. Use last year's spending as a guide.

- Consider a Limited Purpose FSA with your HSA: This lets you use pre-tax dollars for predictable dental and vision costs while leaving your HSA funds untouched and invested for maximum long-term growth.

- Don't Rush to Spend HSA Funds: If you can afford to pay for current medical expenses out-of-pocket, do so. Save your receipts and reimburse yourself years later from your invested HSA funds. This allows your HSA money more time to grow tax-free.

- Stay Informed on Contribution Limits: The IRS adjusts annual contribution limits for HSAs, FSAs, and 401(k)s periodically. Stay updated to ensure you're maximizing your savings potential each year.

- Review Annually: Your healthcare needs, financial situation, and employer benefits can change. Make it a habit to review your elections for all these accounts during open enrollment each year.

Your Next Steps: Building a Healthier Financial Future

Understanding the differences between HSAs, FSAs, and 401(k)s is the first critical step. The next is to take action.

Start by evaluating your current health plan. Are you in an HSA-eligible HDHP? If so, explore opening an HSA and making consistent contributions. Then, look at your employer's 401(k) plan. Are you contributing enough to get the full match? Finally, consider your short-term health and dependent care expenses. Could an FSA (or LPFSA/DCFSA) save you money on those predictable costs?

These accounts are more than just tax breaks; they're integral components of a robust financial strategy. By strategically utilizing HSAs, FSAs, and 401(k)s, you're not just saving money today—you're investing in a more secure and financially resilient future for yourself and your loved ones. Take control, make informed decisions, and watch your financial well-being flourish.